To understand the real importance of insights, you need to be clear on what they are. We’ll often be asked ‘can you provide insights on X brand or Y sector?’ when what the client is really asking for is information.

Insights take time, analysis and interpretation, whereas information is comprised of observations. And while information can be powerful, insights tell us why something is happening, getting underneath the surface and enabling us to connect with customers in more meaningful, distinctive and relevant ways.

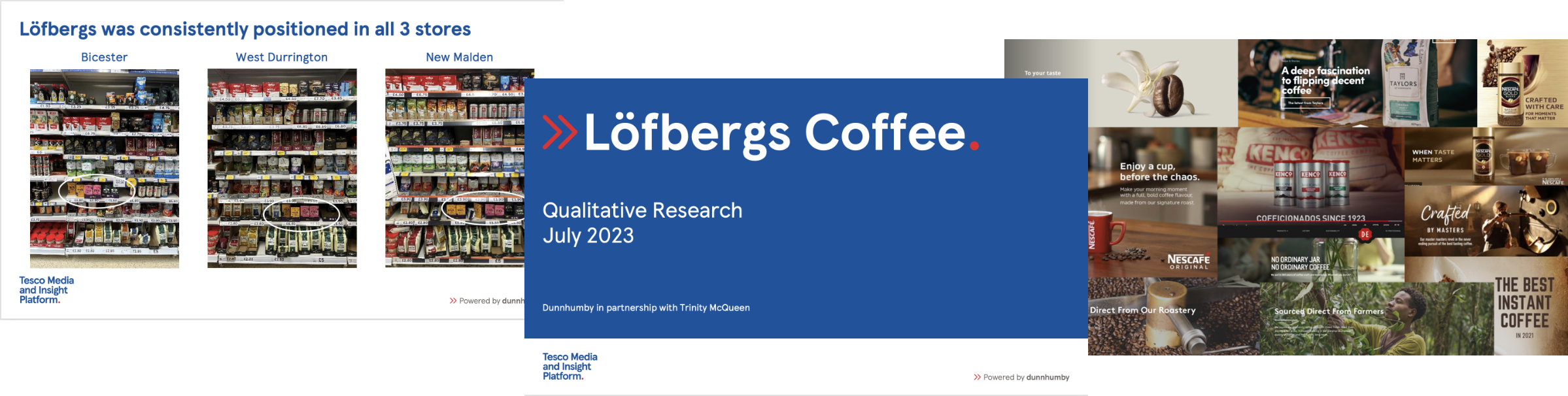

The following examples help demonstrate the power of insight when used by brands in the right way.