Banking on the future: what Gen Z expect from financial brands

Emerging technology and societal change are increasing the pressure on brands to stay relevant to a new generation of customers. Having helped several financial services clients through numerous brand evolutions and reiterations, we know how hard it can be to steer the course between legacy and innovation.

So, while no strangers to evolving their brands, how should financial service companies be thinking strategically to meet the needs of these latest generations? While challenger brands and technology are making headway, they can lack the trust and reliability to reassure younger customers. This trust and reliability are within easier reach for many established brands. Instead, their focus needs to be on understanding the high service expectations of the new generation and transforming their customer journey to meet them.

The new customer landscape: Gen Z and, coming soon, Gen Alpha

Gen Z (born between 1997 and 2010) and Gen Alpha (born between 2010 and 2024) have grown up in economic uncertainty, fostering deep scepticism toward traditional financial institutions and high expectations for ethics and transparency. They value security, ease and transparency – but they also expect brands to meet them where they are with seamless digital experiences, ethical business practices and products that genuinely improve their lives.

There’s also a growing fatigue with brands trying too hard to force relevance. Younger consumers can easily spot inauthentic attempts to insert financial services into their culture. Instead of chasing trends, financial services brands must embed themselves naturally into their customers’ lives and prove their value through meaningful action.

“Financial institutions that truly understand the evolving needs of younger generations will be the ones that thrive in the next decade,” says Alex Goat, Chief Executive of krow’s specialist youth division, Livity. “Gen Z and Gen Alpha want financial brands to be more than service providers; they want partners who help them navigate economic uncertainty, build financial resilience and make informed, ethical choices.”

1. New and evolving customer expectations

Consumer expectations in financial services are shifting rapidly. They are being shaped by digital transformation, economic volatility and changing values. To remain competitive, financial brands must reconsider their approach to trust, reliability and transparency – three pillars that define the evolving relationship between younger generations and financial institutions.

Pillar 1: Trust – security and experience matter

Despite being digital natives, Gen Z trust traditional banks more than big tech companies in terms of data security. This attitude is perhaps shaped by the fact that Gen Z consumers are three times more likely to fall for an online scam than Baby Boomers (Deloitte, 2024). It’s unsurprising, then, that 43% of Gen Z still value physical branches for the peace of mind they provide (Deloitte, 2024).

However, trust isn’t guaranteed – it must be earned and maintained. While banks still offer a sense of stability, they must modernise their customer experiences. The future isn’t just digital-first – it’s customer-first, blending seamless online services with in-person support that adds real value.

Brand and customer experience work hand in hand to build trust. Gen Z expect the best of both worlds – brands that can deliver a seamless digital experience while protecting them with the highest levels of security.

Pillar 2: Reliability – digital services must be exceptional

Gen Z expect intuitive, engaging financial tools. 73% say customer experience is a deciding factor in brand loyalty, and many use neobank apps as their primary budgeting tools (Accenture, 2024). Features like Monzo’s ‘1p saving challenge’ gamify financial habits, proving that thoughtful design can make managing money easier – and even fun.

Money is no longer a private matter. ‘Loud budgeting’ and peer-driven financial education are growing trends, yet many Gen Z consumers still lack financial literacy. According to a 2024 study by McKinsey, 60% of Gen Z say they need more financial education resources.

Gen Z aren’t turning to parents or banks for investing and money management lessons, but social media. Influencer partnerships have exploded, but there’s a catch: a growing scepticism of influencers. Nearly half of Gen Z describe paid partnerships as “insincere” or “annoying”.

Lo-fi recommendations from peers, niche communities and unpolished testimonials are becoming more influential, even though they may offer flawed advice. Financial service brands have a strategic opportunity to step in with guidance, education, community-driven resources and products.

Pillar 3: Transparency – ethics matter more than ever

Younger consumers care. 77% of Gen Z prefer brands that align with their beliefs (Deloitte, 2024). They’re quick to call out inauthenticity. Financial institutions must go beyond performative gestures – ethical finance, sustainable investments and transparent fee structures are becoming essential.

Ethics and sustainability are of growing importance to many customers – including Millennials (1982-1997). Deloitte (2024) found that 62% of Gen Z and 59% of Millennials experience anxiety about climate change and actively seek sustainable financial products. Similar numbers were willing to pay more for environmentally sustainable products or services, and a quarter (25%) have stopped engaging with businesses due to unsustainable practices.

Brands that ignore this shift risk backlash. From festival sponsorship controversies to consumer boycotts, recent history proves that cultural alignment must be genuine, not opportunistic.

“Younger audiences are holding brands to higher ethical standards than ever, demanding transparency and authenticity as non-negotiables,” explains Alex Goat. “This is even more true for large-scale institutions and regulated industries. They will demand to understand your values and practices and engage much more highly with those who align to their own.”

Optimising for new and evolving customer expectations: the key to future success

The evolving relationship shown by these three pillars can help financial services companies recognise how to serve younger generations better by focusing on customer experience. The key is to be useful, make things quicker and easier, and create engaging ways for consumers to interact with financial products.

A framework we employ at krow when reinventing customer experiences is understanding how to ‘save time and seize time’. Brands such as Lloyds and Monzo excel at this, allowing customers to save small amounts automatically – for example, rounding up transactions to the nearest pound or, in Monzo’s case, using IFTTT technology to save £5 every time it rains. These small automated nudges make financial habits effortless and engaging.

Ironically, physical branches could soon become a key point of differentiation and trust-building – we’ve seen digital retail brands launch bricks-and-mortar stores to provide service and keep their brand top of mind.

Rethinking branches as centres for financial education – perhaps even a ‘Money Genius Bar’ – could enhance engagement, build trust and provide meaningful support beyond transactional banking.

Younger generations demand alignment between financial services brands and their cultural values. Content and communications must strike the right balance – authenticity and purpose are critical to avoiding missteps that come across as tone-deaf or opportunistic (think Kendall Jenner’s infamous Pepsi ad).

2. Changing financial habits and needs

The way younger generations manage, invest and think about money is evolving. From the largest intergenerational wealth transfer in history to the rise of social-media-driven financial education, financial services brands must adapt to new behaviours and expectations. What key financial trends are emerging, and what opportunities do they present for brands?

The great wealth transfer

Boomers are the wealthiest generation in history, and over the next 30 years £7 trillion will be passed down (Financial Times, 2024). This shift means younger generations will be more active in investing, requiring more straightforward, accessible financial guidance.

Younger generations are open to investing – Gen Z are 45% more likely to start investing by the age of 21 compared to Millennials. Any wealth transfer could heighten interest in traditional and virtual assets, and structured approaches such as ETFs.

FinTok and the Rise of DIY finance

Social media is now a key source of financial education, with many young consumers trusting ‘FinTok’ influencers over traditional advisors. However, scepticism around paid sponsorships is growing – nearly 50% of Gen Z find branded partnerships insincere (Edelman Trust Barometer, 2024).

Brands that can provide trusted, peer-driven financial guidance have a significant opportunity, as Alex Goat highlights: “The appetite for financial education is enormous, but brands need to be seen as useful, understanding and trustworthy. They must demonstrate an understanding of the specific financial challenges young people are facing today.”

Travel insurance: The risk Gen Z overlooks

Gen Z prioritises experiences over possessions, but many travel without insurance. 20% of 18-43-year-olds have travelled uninsured, often misunderstanding what’s covered by a Global Health Insurance Card (GHIC) (Statista, 2024).

With a crowded insurance market, brands can stand out by simplifying options, cutting out jargon and offering customisable, AI-driven policies that fit younger consumers’ lifestyles.

Travel insurers need to rethink how they engage younger customers – frictionless, digital-first solutions will be key. They also need to play a critical role in educating young people about the critical need for insurance, and drive urgency.

Changing financial habits: bridging the gap between expectation and action

As younger generations take control of their financial futures, they will reshape how financial services operate. From investing earlier to seeking financial advice in unexpected places, their behaviours signal a demand for innovation, transparency and simplicity.

Brands that recognise these shifts and respond with transparent, credible and tailored solutions will gain trust and loyalty. Whether providing reliable financial education, adapting investment services to evolving needs or simplifying essential protections such as travel insurance, financial services brands must meet younger consumers where they are – on their terms.

With these trends in mind, how can financial services brands ensure long-term relevance and success? It starts with understanding what truly connects with younger audiences and translating that into meaningful action.

3. How financial services brands can stay relevant

Adapting to these changing dynamics isn’t just about survival, but building long-term customer relationships. Financial institutions must find ways to connect emotionally, align with consumer values and leverage their brand strengths to remain competitive.

Whether they use new technology, a new proposition or even a new brand to win over the next generations, those who listen to their audience most and can innovate at pace will be more likely to ensure relevance and success.

This dynamic new marketplace requires financial brands to evolve more strategically – to move from being ‘any old brand’ to a loved brand. Here’s how:

- Find an emotional connection – listen carefully to these audiences to solve real problems, understand their pain points and create services that integrate seamlessly into their lives.

- Align with their values – be transparent, ethical and authentic. Find your true brand values and make them part of your organisation’s daily behaviour. Younger audiences won’t tolerate anything less than walking the walk.

- Be useful – make interactions easy, engaging and rewarding. Utility isn’t just a feature – it’s a competitive advantage. Creating an experience that simply flows with the fewest number of steps makes it enjoyable, memorable and shareable.

- Leverage your brand personality – trends come and go, but expressing your brand’s unique strengths in ways relevant to younger audiences creates lasting value. Authenticity beats gimmicks every time, so find your brand truth and bring it to life in the eyes of your audience.

Final thoughts on futureproofing financial services for Gen Z (and Alpha)

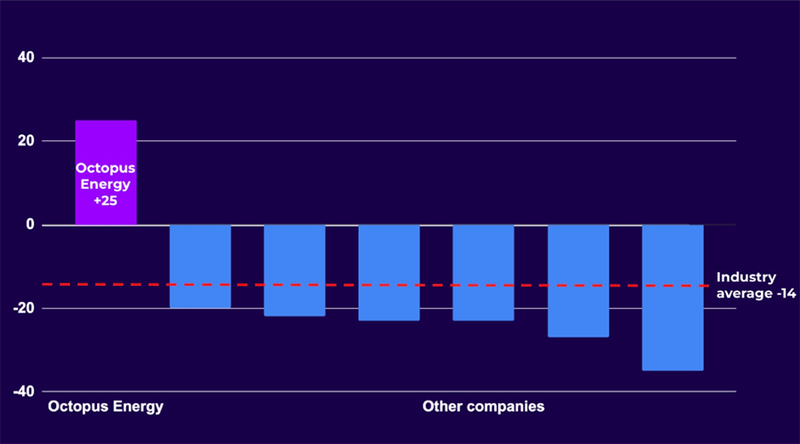

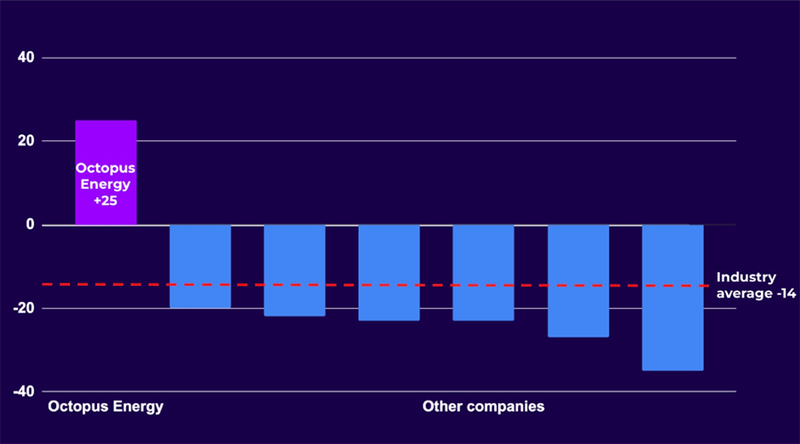

Getting younger audiences to fall in love with a financial service brand may seem daunting, but it can be done. Energy providers have a reputation for being unloved, but Octopus Energy has a net promoter score 39 points higher than the industry average – the highest score in the sector. Social listening reveals a highly engaged and enthusiastic customer base who feel Octopus has understood what they needed and taken action.

Such a transformation takes time, but brands that listen, adapt and innovate can turn trust into lasting loyalty. Success won’t come from chasing trends or just adopting a digital-first mindset – it will come from profoundly understanding what younger audiences need and delivering real, tangible value.

The way people save, spend and invest is evolving, and financial services brands that don’t adapt will be left behind. Younger generations are already shaping the future – brands that move now will be the ones they trust tomorrow.

The financial services industry has a once-in-a-generation opportunity to redefine how it serves younger audiences. Those who take bold, strategic steps today will be tomorrow’s market leaders. It’s time to be bold with your brand.

Sources:

https://www.ft.com/content/c960d291-81aa-4975-bec5-dc20fc9dced3

https://www.deloitte.com/global/en/issues/work/content/genz-millennialsurvey.html

https://www.wysetc.org/2024/08/the-purchase-of-travel-insurance-by-international-youth-travellers

https://www.weforum.org/stories/2023/11/gen-z-banking-finance-money-trends

CHAT TO US

Contact Kirstin Wilson, Client Partnerships Director

kirstin.wilson@krowgroup.com